Gap Federal Credit Union Login

Gap Federal Credit Union Login:Gap Federal Credit Union is a member-owned financial cooperative that offers a range of financial services, including savings accounts, loans, credit cards, and more. As a member of the credit union, you can access your account online through the Gap Federal Credit Union login portal. However, many members may encounter difficulties logging in, especially if they are new to the platform. This article will guide you through the process of Gap Federal Credit Union login, including troubleshooting tips and frequently asked questions.

You can also get details about how to log in to Gap Federal Credit Union Login and Reset the password if you forgot it.

Getting Started with Gap Federal Credit Union Login Official Portal Page

For Gap Federal Credit Union Login Click On the Official portal By Clicking on Login Button Below.

- Go www.mobicint.net/gap/login.

- Enter your Username and Password

- Now Click on Login Button.

- You Can Access Your Details Now.

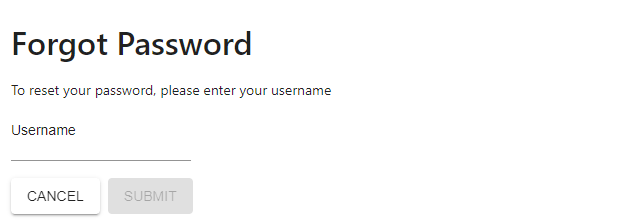

Gap Federal Credit Union Login Password Reset

If you forget the password then you can reset the password by clicking on Forgot Password/ Reset password. If you have forgotten the password to your Gap Federal Credit Union Login account, you may easily reset it by pointing to your web browser by clicking on Forgot Password.

Now You have to enter your Username or Email id to get the reset link on your mail. You can also see the screenshot above for resetting the password.

What is a Gap Federal credit union?

A Gap Federal credit union is a financial institution that is owned and controlled by its members. Credit unions offer a variety of financial products and services, including checking and savings accounts, loans, and credit cards.

Credit unions can be described as financial institutions that are similar to banks but the members of the credit union own the bank. These non-profit entities are not for profit and aim to help their members, rather than make a profit. Because of this, credit unions offer lower fees and loan rates as well as better savings rates.

To join a credit union, you will need to meet some requirements. These requirements will vary depending on the way a credit union was organized. If you are interested in joining a credit union, here’s some information.

Comparison of Gap Federal credit unions and banks

Credit unions and banks do some of the same things, but they have different goals. When you open a bank account and put money in it, you become a customer. Banks have to take care of their shareholders before they take care of their customers.

Credit unions have higher interest rates than banks, but their rates for saving money and getting loans are usually lower.

If there is a bigger difference between savings and loan rates, banks can make more money.

This difference between banks and credit unions is important.

Credit unions are unique because their members own them.

When you put money into a credit union account, you become a member-owner of the credit union.

You are a customer and an owner at the same time.

Like a bank, credit unions use the money you and other members put in to make loans to other members.

Credit unions are mostly about helping the people who belong to them. They take any money that could have been made and use it to help the people who belong to the group. People know that credit unions offer lower rates on both savings and loans. Fees may also be less at credit unions.

The advantages of Gap Federal credit unions

1. Gap Federal credit unions are not-for-profit organizations, while banks are for-profit. This means that credit unions are more likely to have lower fees and offer better rates.

2. Gap Federal credit unions are required to have a board of directors that is democratically elected by the membership. Banks have a board of directors that is appointed by the shareholders.

3. Gap Federal credit unions are required to have a supervisory committee that reviews the financial operations of the credit union. Banks are not required to have a supervisory committee.

4. Gap Federal credit unions are subject to stricter regulations than banks.

5. Gap Federal credit unions are insured by the National Credit Union Administration, while banks are insured by the Federal Deposit Insurance Corporation.

What is the minimum membership requirement to join a Gap Federal credit union?

There is no minimum membership requirement to join a Gap Federal credit union. To join a credit union, members must share something. Credit unions may require that you work for a specific employer, reside in a particular area, or be a member of a group (such as a school or labor union) to join.

Some credit unions will allow you to join an organization even if you don’t meet the requirements. PenFed Credit Union members can join Voices for America’s Troops and the National Military Family Association to become one. Each organization charges $17 for a one-time, non-refundable dues payment.

What is a Gap Federal credit union? How does it work?

What’s the primary purpose of a Gap Federal credit union?

What’s the difference between a Gap Federal credit cooperative and a regular bank branch?

In simple terms, what is a Gap Federal credit union?

Who is the beneficiary of a Gap Federal credit union?

How can Gap Federal credit unions make money?

What are the negatives of Gap Federal credit unions?

Is it public or private Gap Federal credit unions?

Gap Federal Credit unions will check your credit before opening an account.

Are Gap Federal credit unions able to offer interest on savings?

What amount of money can you put in a Gap Federal credit union?

There is no limit to the amount of money you can put in your Gap Federal Credit Union account.

Does Gap Federal credit union affect credit scores?

Which is better, a Gap Federal credit union or a bank?

Conclusion

Logging into your Gap Federal Credit Union account is easy and convenient, allowing you to manage your finances seamlessly. If you encounter any login issues, use the troubleshooting tips outlined in this article or contact customer support for assistance. Take advantage of the benefits of online banking with Gap Federal Credit Union, including easy access to account information, online bill payment, mobile banking, and enhanced security.