Lake Trust Credit Union Login

If you are looking for a lake trust credit union login then check here I have mentioned step by step process for the lake trust credit union login Official portal. I have also given lake trust credit union login official links for login including a screenshot on this post.

You can also get details about how to log in to lake trust credit union login and Reset the password if you forgot it.

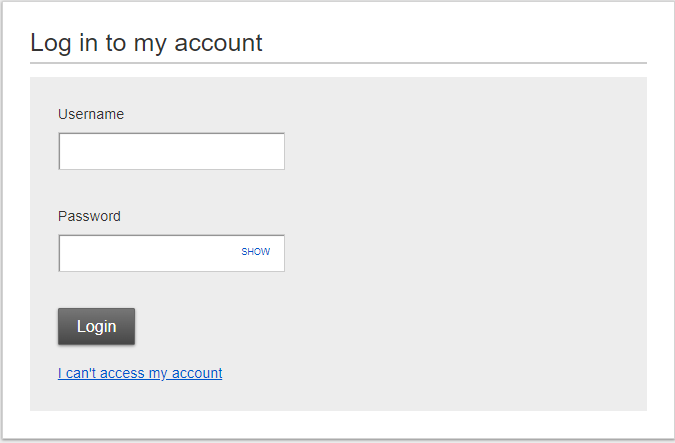

Getting Started with lake trust credit union Login Official Portal Page

Logging into your lake trust credit union account on the official portal page is very easy. All you need to do is follow the steps below:

- Enter your User ID Enter your Password Click on the “Log In” button.

- If you are a new user, you can visit the registration page on the official portal page to create your account.

- If you need assistance with your account, you can visit the Help page on the official portal page.

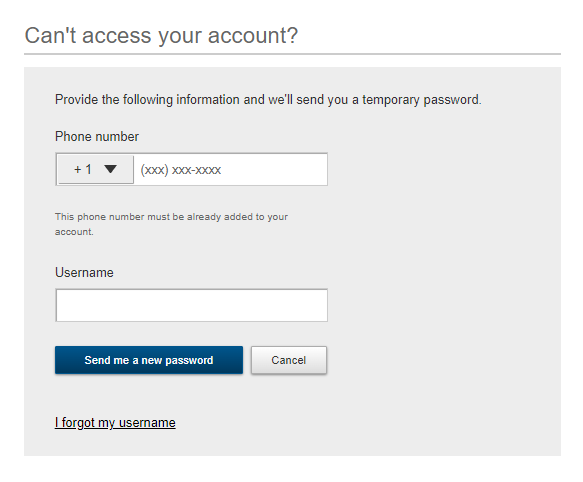

Lake Trust Credit Union Login Password Reset

If you forget the password then you can reset the password by clicking on Forgot Password/ Reset password. If you have forgotten the password to your lake trust credit union login account, you may easily reset it by pointing to your web browser by clicking on Forgot Password.

Now You have to enter your Username or Email id to get the reset link on your mail. You can also see the screenshot above for resetting the password.

What is a Lake Trust credit union?

A Lake Trust credit union is a bank that is owned and run by the people who use it. Credit unions offer a wide range of banking services, such as checking and savings accounts, loans, and credit cards. Lake Trust is a credit union in the state of Michigan. Its members live there.

Credit unions are like banks in that they are financial institutions, but the people who use the credit union own the bank.

These groups aren’t out to make money. Instead, they want to help their members, not make money.

Because of this, credit unions can offer better savings rates and lower fees on loans.

To join a credit union, you must meet certain criteria.

These rules will be different for each credit union, depending on how it was set up.

Here’s what you need to know if you want to join a credit union.

Comparison of Lake Trust credit unions and banks

Lake Trust credit unions are different from banks in a number of important ways. One difference is that credit unions are non-profit organizations and banks are for-profit businesses.

This means that credit unions give their profits back to their members in the form of lower fees and rates, while banks give their profits back to their shareholders. Credit unions are owned by their members, while banks are owned by their shareholders.

This means that credit unions are run by the people who have accounts with the credit union. On the other hand, banks are run by their shareholders, who may not have their customers’ best interests in mind.

Lastly, credit unions are usually smaller and more personal than banks. This means that they may be able to better meet the needs of their members and care more about their local communities.

The advantages of Lake Trust Credit Unions

Credit unions tend to offer more personalized services. Banks may not be located in every community and therefore not have all the decision-makers. Credit unions may be closer to every decision-maker, giving you direct access and information about the decisions regarding your loan application or any other financial transaction.

Other benefits that credit unions might offer include higher interest rates for checking accounts and savings accounts than traditional banks. Online banks might offer higher interest rates than many credit unions. However, they are worth looking into. A credit union, however, will offer you the best rates if your goal is to keep your money locally.

Credit unions often aim to keep their fees as low as possible. Although credit unions still have to charge fees in some cases, they might not have as many fees. They may also charge lower fees than other banks.

Credit unions often offer lower interest rates on loans than local banks.

-Competitive interest rates

-A wide range of products and services

-Friendly, personal service

-A commitment to the community

Advantages of Lake Trust Credit Unions

Some advantages of Lake Trust Credit Union include:

-A wide range of financial services: Lake Trust Credit Union offers a wide range of financial services, including checking and savings accounts, personal loans, and investment products.

-Competitive rates: Lake Trust Credit Union offers competitive rates on its products and services.

-Convenient locations: Lake Trust Credit Union has branches throughout Michigan, making it convenient for members to access their accounts and services.

-Friendly and helpful staff: Lake Trust Credit Union staff are known for being friendly and helpful. They are always willing to assist members with their financial needs.

What is the minimum membership requirement to join a Lake Trust credit union?

There is no minimum membership requirement to join a Lake Trust credit union. To join a credit union, members must share something. Credit unions may require that you work for a specific employer, reside in a particular area, or be a member of a group (such as a school or labor union) to join.

Some credit unions will allow you to join an organization even if you don’t meet the requirements. PenFed Credit Union members can join Voices for America’s Troops and the National Military Family Association to become one. Each organization charges $17 for a one-time, non-refundable dues payment.