Wildfire Credit Union Login

Credit unions are banks that are owned by their members. They are not-for-profit groups that exist to help the people who belong to them. Wildfire Credit Union is a full-service credit union. Its members in Saginaw, Bay, and Midland counties in Michigan can save money, get loans, and use other financial services.

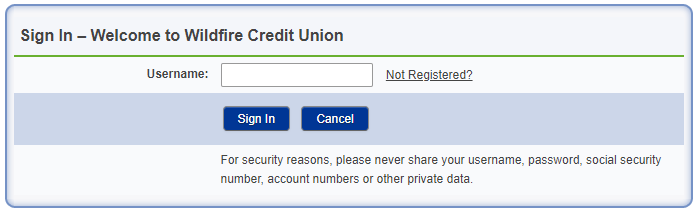

Getting Started with Wildfire Credit Union Login Official Portal Page

For Wildfire Credit Union Login Click On the Official portal By Clicking on Login Button Below.

- Enter your Username and Password

- Now Click on Login Button

- You Can Access Your Details Now.

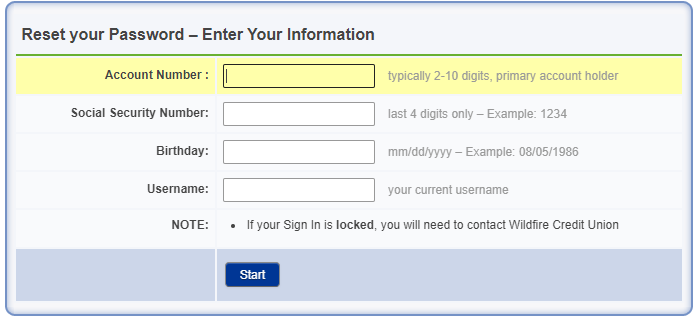

Wildfire Credit Union Login Password Reset

If you forget the password then you can reset the password by clicking on Forgot Password/ Reset password. If you have forgotten the password to your Wildfire Credit Union Login account, you may easily reset it by pointing to your web browser by clicking on Forgot Password.

Now You have to enter your Username or Email id to get the reset link on your mail. You can also see the screenshot above for resetting the password.

What is a Wildfire credit union?

A Wildfire credit union is a financial institution that is owned and operated by its members. Credit unions are not-for-profit organizations that exist to provide members with a safe place to save and borrow money.

Credit unions can be described as financial institutions that are similar to banks but the members of the credit union own the bank. These non-profit entities are not for profit and aim to help their members, rather than make a profit. Because of this, credit unions offer lower fees and loan rates as well as better savings rates.

To join a credit union, you will need to meet some requirements. These requirements will vary depending on the way a credit union was organized. If you are interested in joining a credit union, here’s some information.

Comparison of Wildfire credit unions and banks

Credit unions are better than banks in many ways. In general, credit unions offer higher interest rates on savings accounts, lower interest rates on loans, and the ability to offer products and services that are tailored to the needs of their members.

Credit unions also have better customer service than banks because they are usually smaller and pay more attention to what their customers want. When it comes to certain products and services, credit unions are better than banks in a number of ways.

Most of the time, the interest rates on savings accounts and certificates of deposit are higher at credit unions, while the interest rates on loans are lower.

Also, credit unions often offer unique products and services that meet the needs of their members, such as savings accounts for young people, programs to teach people about money, and loans for community development. When it comes to customer service, credit unions tend to do a better job than banks.

Most credit unions are smaller businesses that care more about what their customers want. Because of this, credit unions tend to give their members more personal service and care.

Also, credit unions usually have lower fees than banks, and they offer services that banks don’t, like financial counseling and loans for community development.

The advantages of Wildfire credit unions

– They are member-owned, so profits are reinvested in the community instead of going to shareholders. – They offer lower fees and higher interest rates on savings accounts than traditional banks. – They are local, so members can get personal service and support for their financial needs.

Advantages of Wildfire credit unions

Although credit unions offer many wonderful services to members, they are not always better than banks. Before you can become a credit union member, you have to meet the membership requirements. You can’t join the credit cooperative if you don’t meet these requirements.

Because credit unions are smaller, they don’t have the resources or budget to provide the same services as large banks. Credit unions may use technology, such as apps, that is not available to large banks. Credit unions might not be able to offer the same products as big banks.

Credit unions tend to have a small number of locations. These locations are usually only available in the areas that the credit union serves. If you are traveling out of your area and need to speak to a credit union employee, you will most likely be in trouble.

What is the minimum membership requirement to join a Wildfire credit union?

There is no minimum membership requirement to join a Wildfire credit union.

To join a credit union, members must share something. Credit unions may require that you work for a specific employer, reside in a particular area, or be a member of a group (such as a school or labor union) to join.

Some credit unions will allow you to join an organization even if you don’t meet the requirements. PenFed Credit Union members can join Voices for America’s Troops and the National Military Family Association to become one. Each organization charges $17 for a one-time, non-refundable dues payment.

What is a Wildfire credit union? How does it work?

What’s the primary purpose of a Wildfire credit union?

- A. To promote savings and provide credit to members

- B. To serve as a financial institution for members of the military

- C. To provide members with access to banking services

- D. To promote economic development in the community